Maybe you are one of those parents that really feels completely financially gotten ready for your expanding family members. If so, you do not require to read this post. In fact, we wish to interview you as a minor miracle of modern-day parenting. For the remainder people, understanding how to take care of always-limited cash and also our relatively unrestricted needs is a complex and also frequently discouraging issue. New being a parent and also young kids just make the problem that a lot bigger.

You might think about financial planners as the specialists who assist rich people handle their money. Nonetheless, financial planners likewise have a lot of excellent guidance to assist the remainder people handle our absence of money. We spoke to 2 economic preparation experts as well as asked for their crucial recommendations for new parents as well as young family members.

Judy Miller is a Licensed Economic Organizer and also directs University Solutions, a company that concentrates on assisting moms and dads prepare for their children’s education. Lisa Leff is vice president and profile supervisor for Trillium Possession Monitoring Firm, a business that assists customers, including many with little ones, use their money to achieve both economic and also social objectives. Below are their leading 5 financial tips for brand-new parents and also young families:

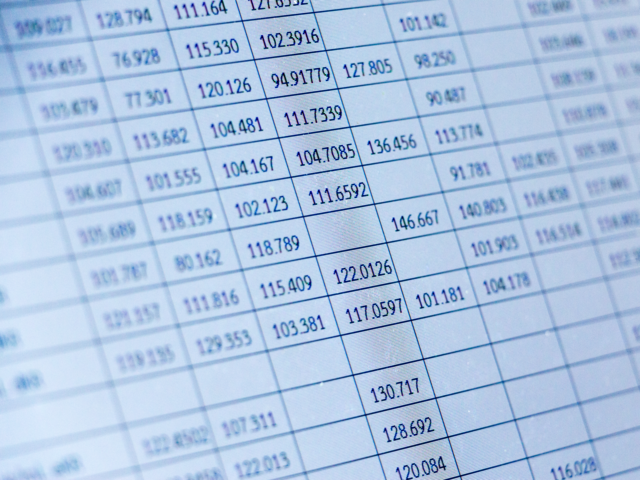

1. Pay yourself first – This is the structure of good family finances: Do not have every cent you make quickly head back out the door. “Determine just how much you are going to save for emergencies, retired life and also college,” says Miller. “Conserve out of every income, reward and raise. Conserving now indicates you’ll invest yourselves rich later on.”

That seems good. Yet exactly how the hell do you conserve? Have your children use their baby diapers for longer stretches? Restrict your partner to one shower a week? Learn to like beans for dinner? According to the professionals, the most important action is merely to choose to make conserving a top priority. As soon as you have done that, the “just how” is a great deal simpler. So make a family dedication to paying yourselves initially.

2. Find out exactly how to spend – There are 2 fundamental classifications of investing: the little stuff as well as the big stuff. Not knowing how to spend sensibly on either can get you right into economic trouble.

Initially, just how do you invest sensibly on the big stuff? Miller’s guidance starts delicately. “Rein in your use of credit cards,” she states. “Financial debt today burglarizes you of tomorrow’s desires.”

For those of you who have difficulty figuring out how to “rein in,” she has more radical guidance: “Do not bring bank card with you. Needing to return home to get them means you have to actually think of the worth of what you are getting on credit scores. Where feasible, wait at least 24 hours prior to making any kind of purchase higher than $500.” The lady talks from experience – she locked her credit cards up in her secure deposit box. Click on this link to learn more tips on Financial Advice.

That benefits the big stuff, but the smaller things requires figuring out exactly how to utilize your daily bucks intelligently. There are some exceptional resources offered to aid you do this, with guidance on every little thing from establishing a budget to hosting less expensive birthday celebration celebrations. (See sidebar for a checklist.).

3. Plan for the unforeseen – This is not information for parents, as we are supervisors of the unexpected. However planning for undesirable shocks goes beyond extra garments in the baby diaper bag.

” While no one suches as to think of dealing with tough times, it is essential to be prepared,” claims Leff. “Be sure to have appropriate life insurance policy and an up-to-date will, and also check out trust funds as well as other alternatives with an estate attorney to ensure your properties will be secured as well as readily available to your child.”.

In case you’re wondering, trust funds aren’t just for abundant people, as well as wills aren’t just for individuals who are old. Both are exceptional tools for making sure you have a say in exactly how your children are dealt with if something need to happen to you and your spouse.

Surprisingly, life insurance as well as wills don’t require a great deal of money and time to take into place. For wills, there are 2 options: do it yourself or speak with an attorney. It’s a little bit like doing your taxes – if you agree to invest a great deal of time analysis and researching as well as your scenario is relatively straightforward, among the online will kits might allow you to do your own will.

If you don’t wish to place in the moment or you require more than an extremely simple will, it is recommended to consult a legal representative – the issues included are very vital. General technique and also household lawyers will commonly generate a simple will certainly for around $300 to $500. You can keep costs down by being well prepared before you check out the legal representative’s office, prepared to respond to questions regarding guardianship of your kids and also an executor for your will.